Category Archives: Blog Category

-

Do you charge QST on online sales to Quebec customers?

Posted on May 16, 2015 by admin in Blog Category.If you are located in British Columbia; You have on-line sales; you ship products from BC to your out-of-province customers, do you need to charge QST or any other provincial tax? I found this article is very helpful. ******************************************************** “If I am making online sales to people in other provinces, do I have to charge […]

Continue Reading... No Comments. -

Commission Employee?

Posted on March 18, 2015 by admin in Blog Category.http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns206-236/229/cmmssn/cndtns-eng.html ******************************************************************** Employment conditions (commission employees) To deduct employment expenses you paid to earn commission income, you have to meet ALL of the following conditions: •Under your contract of employment, you had to pay for your own expenses. •You were normally required to work away from your employer’s place of business. •You were paid in […]

Continue Reading... No Comments. -

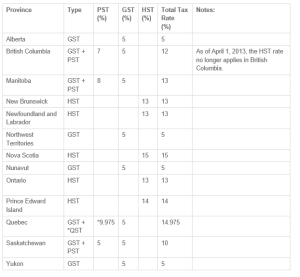

GST & HST Rates – easy to check it by province

Posted on February 24, 2015 by admin in Blog Category. Continue Reading... No Comments. -

USA IRS: how many types of Business taxes (Federal Level)

Posted on February 19, 2015 by admin in Blog Category.According to the United States Internal Revenue Service (IRS), businesses can incur four basic kinds of federal taxes. They include income tax, self-employment tax, employment tax, and excise tax. In addition to these taxes, each state requires that businesses pay certain taxes. In all cases, the way a business operates determines which taxes it owes. […]

Continue Reading... No Comments. -

What is New Family Tax Cut

Posted on February 17, 2015 by admin in Blog Category.The October 30th 2014, Canada Federal Government made 2014 announcement that included a proposal to introduce the Family Tax Cut, a new non-refundable tax credit of up to $2,000 for eligible couples with minor children based on the net reduction of federal tax that would be realized if up to $50,000 of an individual’s taxable […]

Continue Reading... No Comments. -

Employer, do you need to file TA/T4A summary online?

Posted on February 10, 2015 by admin in Blog Category.Internet File Transfer – If you use payroll, commercial, or in-house developed software to manage your business, you can submit files of up to 150 MB over the Internet using the Internet file transfer application. Web Forms – Ideal for smaller returns use the Web Forms application to create, save, validate, and electronically file an […]

Continue Reading... No Comments. -

Commission employees

Posted on February 6, 2015 by admin in Blog Category.Commission employees To deduct the expenses you paid to earn commission income, you have to meet certain conditions. Employment conditions (commission employees) To deduct employment expenses you paid to earn commission income, you have to meet all of the following conditions: • Under your contract of employment, you had to pay for your own expenses. […]

Continue Reading... No Comments. -

Hiring a baby-sitter?

Posted on February 2, 2015 by admin in Blog Category.You may be considered an employer if you hire a baby-sitter and you: •Establish regular working hours (e.g. 9 a.m. to 5 p.m.) •Assign and supervise the work done If you are the employer, you will be considered a sole proprietor and you will need a payroll account. These steps will help you understand your […]

Continue Reading... No Comments. -

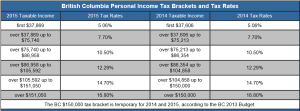

Year 2015 BC Personal Income Tax Bracket and Tax Rate

Posted on January 31, 2015 by admin in Blog Category. Continue Reading... No Comments. -

Working income tax benefit (WITB)

Posted on January 31, 2015 by admin in Blog Category.1. What is the working income tax benefit? The working income tax benefit (WITB) is a refundable tax credit intended to provide tax relief for eligible working low-income individuals and families who are already in the workforce and to encourage other Canadians to enter the workforce. You can claim the WITB on line 453 of […]

Continue Reading... No Comments.