Monthly Archives: January 2015

-

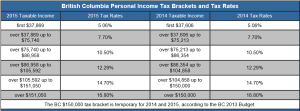

Year 2015 BC Personal Income Tax Bracket and Tax Rate

Posted on January 31, 2015 by admin in Blog Category. Continue Reading... No Comments. -

Working income tax benefit (WITB)

Posted on January 31, 2015 by admin in Blog Category.1. What is the working income tax benefit? The working income tax benefit (WITB) is a refundable tax credit intended to provide tax relief for eligible working low-income individuals and families who are already in the workforce and to encourage other Canadians to enter the workforce. You can claim the WITB on line 453 of […]

Continue Reading... No Comments. -

BC Stat Holiday – Year 2015

Posted on January 30, 2015 by admin in Blog Category, Uncategorized.2015 Statutory Holidays January 1, 2015 New Year’s Day Thursday February 9, 2015 Family Day Monday April 3, 2015 Good Friday Friday April 6, 2015 Easter Monday Monday May 18, 2015 Victoria Day Monday July 1, 2015 Canada Day Wednesday August 3, 2015 B.C. Day Monday September 7, 2015 Labour Day Monday October 12, 2015 […]

Continue Reading... Comments Off on BC Stat Holiday – Year 2015 -

Students can save at tax time

Posted on January 30, 2015 by admin in Blog Category.Did you know? The Canada Revenue Agency (CRA) has tax credits, deductions, and benefits to help students. File your income tax and benefit return and claim them. Important Facts Here are the top savings at tax time: •Claim your eligible tuition fees – Tuition fees paid to attend your post-secondary educational institution for the tax […]

Continue Reading... Comments Off on Students can save at tax time -

We launch the website today

Posted on January 29, 2015 by admin in Blog Category.Actually my expertise really is accounting… but… let’s get the job done. not too difficult : -)

Continue Reading... No Comments.