Yearly Archives: 2015

-

Classes of depreciable properties

Posted on November 30, 2015 by admin in Blog Category.Depreciable properties are usually grouped into classes. To claim CCA, you should know about the following classes. Class 8 The maximum CCA rate for this class is 20%. Musical instruments are included in Class 8. Class 10 The maximum CCA rate for this class is 30%. You include motor vehicles and some passenger vehicles in […]

Continue Reading... No Comments. -

Common business expenses

Posted on October 15, 2015 by admin in Blog Category.The expenses you can deduct include any GST/HST you incur on these expenses less the amount of any input tax credit claimed.You cannot deduct personal expenses, deduct only the business part of expenses from business income. List of expenses •Advertising (Line 8521) •Allowance on eligible capital property (Line 9935) •Bad debts (Line 8590) •Business start-up […]

Continue Reading... No Comments. -

Washington state department of Revenue Local Sales and Use Tax rate

Posted on July 24, 2015 by admin in Blog Category.http://dor.wa.gov/docs/forms/excstx/locsalusetx/localslsuseflyer_quarterly.pdf The Washington (WA) state sales tax rate is currently 6.5%. Depending on local municipalities, the total tax rate can be as high as 9.5%. Other, local-level tax rates in the state of Washington are quite complex compared against local-level tax rates in other states. Washington sales tax may also be levied at the city/county/school/transportation […]

Continue Reading... No Comments. -

Insurance Agents & Brokers – completely GST exempted?

Posted on July 13, 2015 by admin in Blog Category.The answer is no. Insurance agents or brokers may be employees of an insurance company, an insurance agency or a brokerage firm, or they may be self-employed persons. They may be involved solely in offering insurance policies, or they may provide a variety of services including risk management, consulting or advisory services. Therefore, it is […]

Continue Reading... No Comments. -

Donate personally or through corporation?

Posted on July 1, 2015 by admin in Blog Category.1. personal donation: If you or your spouse or common-law partner made a gift of money or other property to certain institutions, you may be able to claim a federal and provincial or territorial non-refundable tax credit when you file your return. Generally, you can claim all or part of this amount, up to the […]

Continue Reading... No Comments. -

Do you charge QST on online sales to Quebec customers?

Posted on May 16, 2015 by admin in Blog Category.If you are located in British Columbia; You have on-line sales; you ship products from BC to your out-of-province customers, do you need to charge QST or any other provincial tax? I found this article is very helpful. ******************************************************** “If I am making online sales to people in other provinces, do I have to charge […]

Continue Reading... No Comments. -

Commission Employee?

Posted on March 18, 2015 by admin in Blog Category.http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns206-236/229/cmmssn/cndtns-eng.html ******************************************************************** Employment conditions (commission employees) To deduct employment expenses you paid to earn commission income, you have to meet ALL of the following conditions: •Under your contract of employment, you had to pay for your own expenses. •You were normally required to work away from your employer’s place of business. •You were paid in […]

Continue Reading... No Comments. -

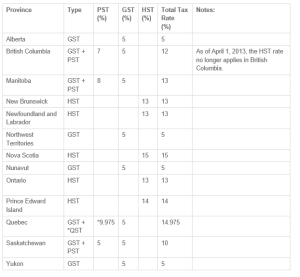

GST & HST Rates – easy to check it by province

Posted on February 24, 2015 by admin in Blog Category. Continue Reading... No Comments. -

USA IRS: how many types of Business taxes (Federal Level)

Posted on February 19, 2015 by admin in Blog Category.According to the United States Internal Revenue Service (IRS), businesses can incur four basic kinds of federal taxes. They include income tax, self-employment tax, employment tax, and excise tax. In addition to these taxes, each state requires that businesses pay certain taxes. In all cases, the way a business operates determines which taxes it owes. […]

Continue Reading... No Comments. -

What is New Family Tax Cut

Posted on February 17, 2015 by admin in Blog Category.The October 30th 2014, Canada Federal Government made 2014 announcement that included a proposal to introduce the Family Tax Cut, a new non-refundable tax credit of up to $2,000 for eligible couples with minor children based on the net reduction of federal tax that would be realized if up to $50,000 of an individual’s taxable […]

Continue Reading... No Comments.